The insurance industry is in the midst of a radical shift. As customers embrace digital channels and technologies in their everyday lives, they bring with them heightened expectations of what claims processing should look like.

Customers expect a seamless claims process, with efficient resolutions and clear communication throughout. When these expectations are not met and the customer has a bad claims experience, insurer costs surge. As a result, claims handling could be considered the most important and volatile interaction between customers and insurance companies.

It is vital that insurance companies digitally transform both their customer facing and back-office operations to improve customer experience, efficiency, and effectiveness. This adaptation takes the form of digital claims processing.

What is Digital Claims Processing?

Proactive claims management is arguably the most critical component of an insurers’ ability to protect their customers and themselves. In order to be successful in this element of operations, many companies are utilizing new claims technology and moving to digital claims processing.

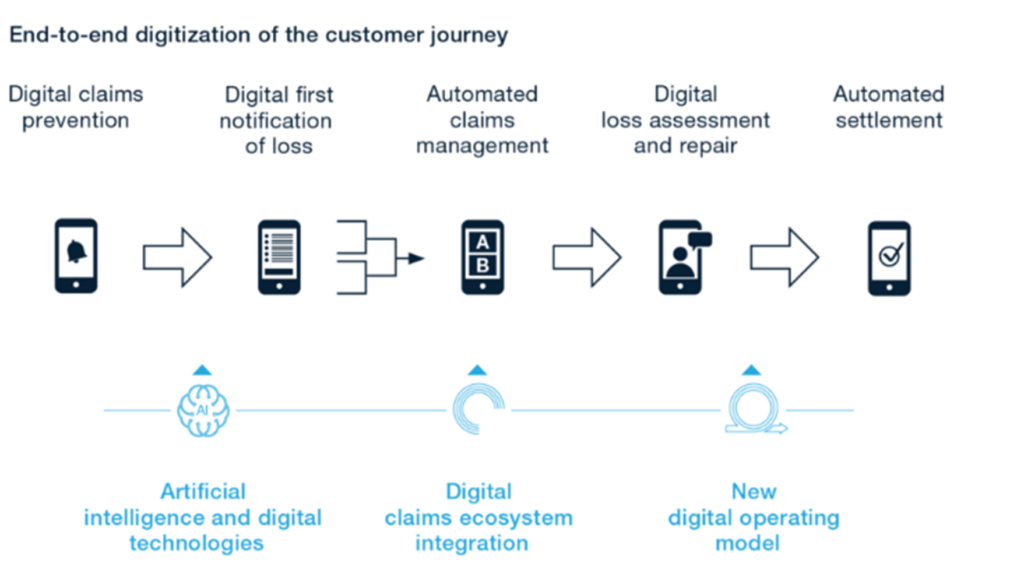

Digital claims processing involves the use of technology to collect, investigate and manage claims. This end-to-end digitization allows insurers to oversee every step of the claims process, from submitting requests to settlement, while separating themselves from competitors.

The process of digitalizing the claims customer journey has many considerations. Yet, it is worth the effort. McKinsey & Company reports that digital claims transformations generate impact across several foundational key performance indicators, observing an improved claims handling accuracy and a 25-30% reduction in claims expenses. An automated claims process that encompasses several areas of insurance functions is now a vital part of insurance companies.

Today’s insurers must find a balance between fostering automation and preserving a human touch for the best customer experience. For example, claims processing may start with automated data collection that sorts requests and identifies red flags that trigger data transfer to an individual or team for a more detailed investigation.

The Benefits of Digital Claims Processing

While waves of digital automation continue to permeate the insurance industry, it can be difficult to understand the benefits of enacting such digital transformation in a single insurance company. The impact of digital automation is advantageous and diverse, with end-to-end digitization changing both customer and insurer experiences. These benefits are:

1. Improved Customer Experience

Digital claims processing allows insurers to deliver a better customer experience, with self-service portals enabling customers to submit claims themselves and check their claims status anytime. Meanwhile, back-office automation removes the negative impact of routing issues while ensuring secure and efficient communication.

An improved customer service paired with an increasing level of automation leads to greater trust between customers and insurers.

2. Faster Claims Processing

Digital claims processing streamlines claims management, with a reduction in time-to-settle regardless of whether insurers work in the office or from home. Insurers have tools which optimize task management, communication, and routing which are more efficient when third party involvement is necessary.

Claims technology enables claims cycle times to be reduced, providing greater flexibility and opportunity for individuals, teams, and companies. Back-office automation allows documents to be gathered and shared quickly and securely, with comments and instructions eliminating the possibility of miscommunication and further error.

3. Increased Accuracy in Claims Reporting

Without the use of digital tools, insurers are left dedicating the majority of their time to routine processes rather than focusing on resolving complex claims. A shift to digital claims processing removes the issue of human error and frees up insurers from operational tasks. This allows them to achieve more accurate claims reporting and dedicate efforts towards the customers instead.

4. Modernized Operations and Faster Innovation

PwC reported that 67% of insurance CEO’s believe innovation to be an important aspect of their company. Modernized operations within claims management provides a greater ease of innovation for further development, allowing insurers to introduce new products to market faster. This causes a domino effect, improving other insurance functions as a result.

5. Reduced Fraud

In an increasingly digital world, insurance fraud is a regular occurrence. Digital claims processes with AI-powered anti-fraud technology provide support by detecting false information automatically. These tools can recognize fraud in loss images, fake documents, and detect suspicious medical bills.

Digital claims processing can transform the capabilities of claims management, developing an area of uncertainty into a source of competitive advantage, market differentiation and customer loyalty. This digital transformation generates a richer, more data-driven and analytics-enabled claims process, with reduced claims cycle times and cost.

Digital Claims Processing with Ondox

Digital claims processing can empower insurers and lift the weight of manual operations off their shoulders, freeing up time and energy. But how is this possible?

The Ondox digital mailroom solution ensures speed, simplicity and security during claims management, and also:

- Validates claim documentation faster

- Reduces time-to-settle

- Improves claimant experience

- Cuts costs of paper-based processing

In order to further streamline claims processing, the Ondox digital mailroom solution simplifies document viewing, approval and forwarding while improving productivity. Furthermore, insurers can organize and compile documents in case management folders, with an audit trail of document interactions and data changes provided on the same interface.